This was achieved through new business wins as well as supporting our customers' pricing initiatives and promotional campaigns.

GROUP REVENUES

We continued to show good sales growth for the year despite tough trading conditions, with like-for-like sales growth of 5.4%.

This increase was almost entirely volume driven through successful participation in promotional activities, new product

launches and new business development. Our pricing, which excludes the one-off costs of promotion activity, remained

relatively flat as raw material inflation stabilised during Fiscal Year 2012 and price increases negotiated to offset

the effect of the inflation during 2011 remained in place. For further analysis of the Group's revenue performance refer

to our Business Review.

GROSS PROFIT

The gross profit margin for 2012 was 26.9%, representing a year-on-year increase of 90 basis points. Through a combination

of successful new product developments and effective promotional campaigns the Group has seen its gross margin return to

levels experienced prior to 2011, a year which was materially affected by unprecedented raw material inflation.

DISTRIBUTION AND OTHER ADMINISTRATIVE COSTS

Distribution and other administrative costs increased by £15.2 million, or 4.3%, as further costs were incurred to

support our investments in innovation and technical excellence to strengthen our leading competitive position.

Furthermore, additional personnel costs were incurred to deliver like-for-like sales growth; engineering costs

increased to support the final stages of capital investments; and utility costs also increased as a result of inflation.

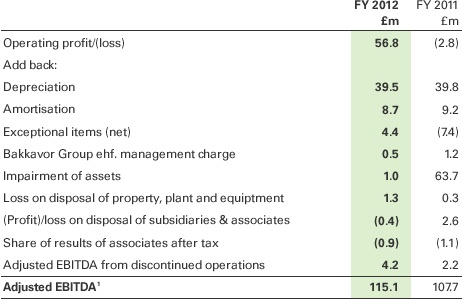

ADJUSTED EBITDA

The adjusted EBITDA for the Group was £115.1 million, compared with £107.7 million in 2011, an increase of £7.4 million

or 6.9%. Adjusted EBITDA margin increased by 40 basis points from 6.4% in 2011 to 6.8% in 2012.

1 Adjusted EBITDA: excludes restructuring costs, management charges to the Group's parent company, asset

impairments and those additional charges or credits that are one-off in nature and significance.

RECONCILIATION TO ADJUSTED EBITDA1

For further analysis of the Group's adjusted EBITDA performance refer to our Business Review.

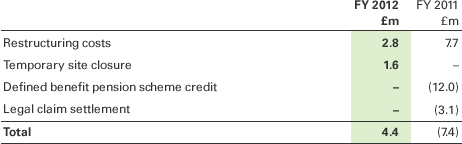

EXCEPTIONAL ITEMS

During the year, the Group incurred certain one-off costs as part of a restructuring programme to improve long-term

operating performance, particularly in Europe. The costs incurred to implement this restructuring amounted to £2.8

million in the year, the majority of which comprised redundancy costs.

The exceptional costs relating to the temporary closure at one of our manufacturing sites following a malicious and

isolated act of contamination in the year amounted to £1.6 million. This charge related primarily to the costs

associated with the disposal of products, extending our installation of CCTV cameras, and the increased costs of

working, which included additional labour costs and further security measures.

The exceptional non-cash credit of £12.0 million in 2011 related to the fall in the present value of the defined

benefit pension scheme liabilities following the closure of the Group's scheme to future accrual. Finally, the

Group received £3.1 million in 2011 following the conclusion of a legal settlement in respect of a trading dispute.

Exceptional items are those that, in management's judgement, should be disclosed by virtue of their nature or amount.

Exceptional items comprised:

IMPAIRMENT

Each year the Group is required to assess the appropriateness of its goodwill carrying value by comparing the asset

values with future cash flows expected to be generated from those assets. No impairment of goodwill or intangible

assets has been recognised in 2012, although an impairment of £1.0m was recognised in relation to tangible fixed

assets which were made redundant. In 2011, an impairment charge of £63.7 million was recognised reflecting a

write-down in the carrying values of goodwill, intangible assets and tangible fixed assets due to the combination

of adverse trading conditions and management's decision to exit certain low-margin businesses.

OPERATING PROFIT

The Company generated an operating profit of £56.8 million (2011: loss of £2.8 million). In 2011, an impairment

charge of £63.7 million was recognised but the effect of this was partially offset by a £12.0 million exceptional

credit in 2011 relating to the benefit arising from the closure to future accrual of the defined benefit pension

scheme. After stripping out the effect of these items, the Group's operating result improved by £7.9 million in

2012, reflecting the improved sales volumes and factory performance efficiencies.

NET DEBT AND INTEREST

The Group's net debt totalled £563.9 million (2011: £591.4 million), representing a reduction of £27.5 million. In line with the term loan amortisation profile, £4.9 million was repaid. An additional £19.7 million was repaid from the funds generated from the equity issue in the Group's parent company, Bakkavor Group Limited, plus proceeds from the sale of two vacant properties.

Net finance costs have reduced from £64.9 million in 2011 to £61.1 million in 2012. This decrease was due to a reduction in average indebtedness over the period coupled with certain long-term fixed rate interest swaps maturing in the year. This decrease was partially offset by refinancing costs related to the corporate re-organisation earlier in the year.

TAX

The Group recorded a tax charge of £2.8 million (2011: £2.5 million credit) as the Group became profitable in 2012.

In addition, a provision was recognised this year to cover certain tax charges that may now materialise in relation to prior years.

DISCONTINUED OPERATIONS

The Group has reached formal agreement with Agrial, Société Cooperative Agricole et Agro-alimentaire, a leading European food

co-operative, for the sale of its French and Spanish produce businesses comprising Cinquième Saison Saint-Pol SAS, Cinquième

Saison Mâcon SAS, Bakkavor France SAS, Crudi SAS and Sogesol SA for 33 million Euros debt-free cash-free.

Completion of the transaction is subject to competition authority clearance, which is expected by the end of the first half of

2013. These operations have been accounted for as discontinued operations and are therefore shown separately in the Group's

income statement.

PENSIONS

At 29 December 2012, the defined benefit surplus was £10.0 million (2011: £9.3 million surplus). There has been little

movement in this surplus as the increase in the fair value of scheme assets has been broadly offset by a broadly

equivalent increase to scheme liabilities. The defined benefit pension scheme is subject to a triennial valuation

as at March 2013.

OTHER GAINS & LOSSES

Other gains of £8.4 million (2011: gain of £6.0 million) included a £6.4 million credit arising on the change in

fair value of interest rate swaps. During the year, £250 million of interest rate swaps matured leaving £50 million

outstanding as at 29 December 2012, which matures in September 2017.

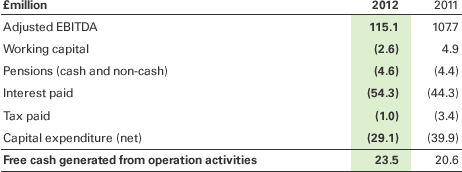

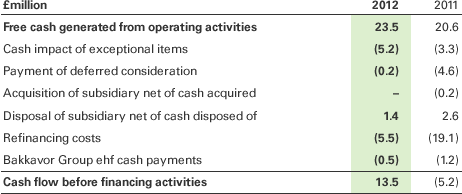

CASH FLOW

Free cash generation from operations

Free cash generation before financing activities

FREE CASH GENERATED FROM OPERATING ACTIVITIES

The increase in free cash generation in the year is attributable to an improved profit performance and a decrease

in capital expenditure (referred to below). Offsetting this was an increase in interest payments arising from the

payment profile attached to the Senior Secured Notes. These notes were issued in February 2011 with interest

payable semi-annually in arrears in February and August. As a result, only one interest payment was required

in the first year.

CAPITAL EXPENDITURE

Our 2011 capital expenditure programme focused on capacity enhancements across our portfolio of sites to support

our growth objectives and strengthen our market-leading positions. Whilst we have continued to invest in a broad

range of projects in 2012, our focus has been to ensure the successful integration of these prior year investments.

Nonetheless, we expect capital spend to increase in 2013. In the event of having to respond to an adverse economic

environment and manage the broader cash requirements of the business as a whole, we continue to retain flexibility

in our discretionary capital spend.